Read our updated analysis – 7 November

2024

This

Fuel for Thought edition offers an excerpt from

our new special report, 2024 US election and the automotive

ecosystem: How much change to expect?

One of the most impactful presidential elections in United

States history is scheduled for November 5, 2024. Regardless of the

outcome, the following issues are expected to directly affect the

US auto industry:

- The perception of an existential threat from mainland Chinese

automakers and technology companies; - Positions on environmental policy, particularly as relates to

vehicle emissions and safety regulations; - Trade policy as it relates to both USMCA and potential for

national security tariffs; and - Positions relative to unions and labor.

At S&P Global Mobility, we're looking at every possible

scenario and how various outcomes may change (or not change) the

bigger picture for the auto industry.

It is important to note that policy changes will not be

immediate and could take most of the next presidency to execute.

Even after the election, the trajectory of the new administration

and their focus will not be known until early- to mid-2025.

We expect many companies are likely holding major decisions

until after the makeup of the White House cabinet and advisors

becomes clearer, as well as taking time to understand the impact of

the Congressional and state elections.

As an example, Republicans are vocal about wanting to reduce

funding for the federal programs under the Inflation Reduction Act.

Some states with automotive industrial investment vote Republican

and others vote Democrat. House and Senate representatives from

those states have a stake in maintaining an inviting economic

environment for the district or state they represent as well as

loyalty to party affiliation. The outcome can cause voting along

party lines which may conflict with constituent priorities, and

vice versa.

In

our new special report, we detail several scenarios and how we

see they may unfold from a policy perspective. For anyone with a

stake in the industry, shifting to a scenario mindset becomes

critical for decision-making. A single forecast is only one

guideline. Critical decisions need to consider business and market

demand issues in the context of upper and lower bounds derived from

plausible scenarios, along with a baseline forecast.

Potential policy changes, depending on the scenario,

include:

- 2028+ federal emissions and fuel economy regulations

- Inflation Reduction Act funding future

- Mainland China sourcing tariffs

- California: Does its ability to regulate emissions

continue? - 2026 USMCA Review

Most Likely Outcomes

There are four principal outcomes for the election itself.

S&P Global Mobility does not predict which party will win,

though we do expect the most likely results will be a split

Congress regardless of whether the Republican or Democratic party

wins the White House. Those are the two scenarios we focus on in

our report.

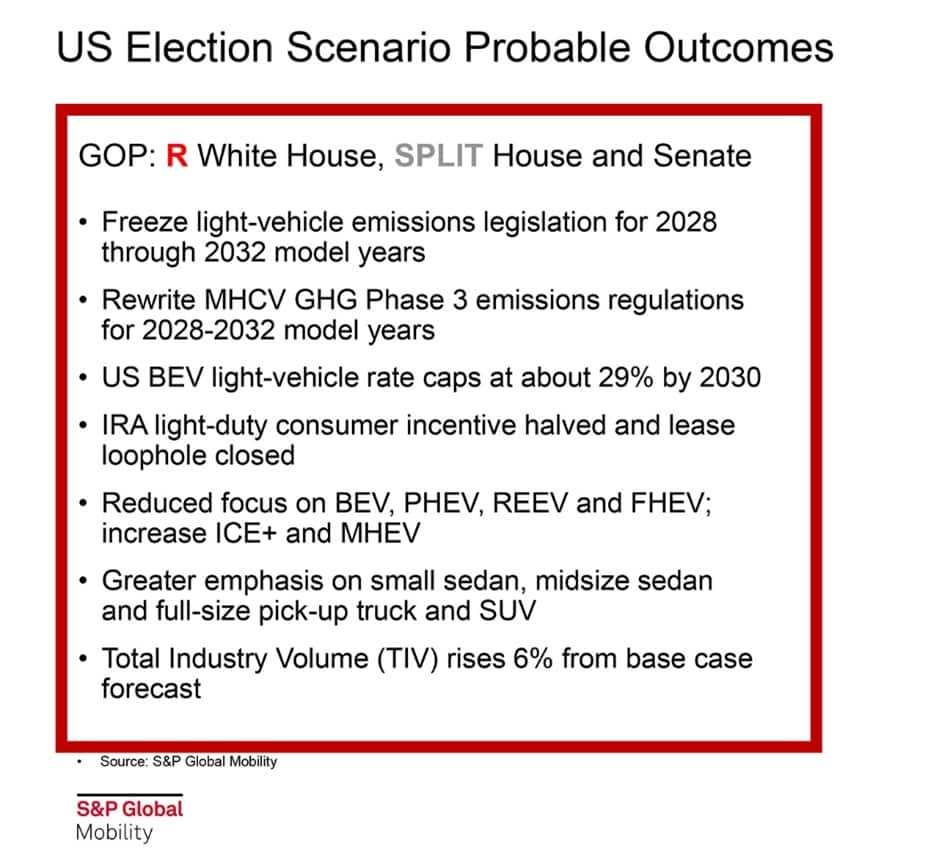

If the Republican party wins the White House

and there is a split House and Senate then we expect there will be

a decision to freeze the emissions legislation covering model years

2028 through 2032. This freeze would effectively hold the

regulations set for 2027 model year steady through at least 2032

model year. We would also expect to see consumer tax credits in the

IRA law cut by half, and the current lease loophole to be

closed.

Our scenario forecast in this case sees US battery electric

vehicle (BEV) market share of new light vehicle sales reaching

about 29% by 2030. We would expect the change in emissions

regulations to result in a reduced focus on higher levels of

electrification (including BEV, plug-in hybrid, range-extender

electric and fuel-cell electric solutions), but an increase in

internal combustion engines with mild levels of electrification and

mild-hybrid solutions.

In this scenario, the impact may include lower vehicle pricing,

less pressure for consumer behavioral change, a greater emphasis on

small and midsize sedans, as well as full-size pick-up and SUV

segments. Overall, we see this scenario with a 6% increase in total

industry volume (TIV) from the base case today.

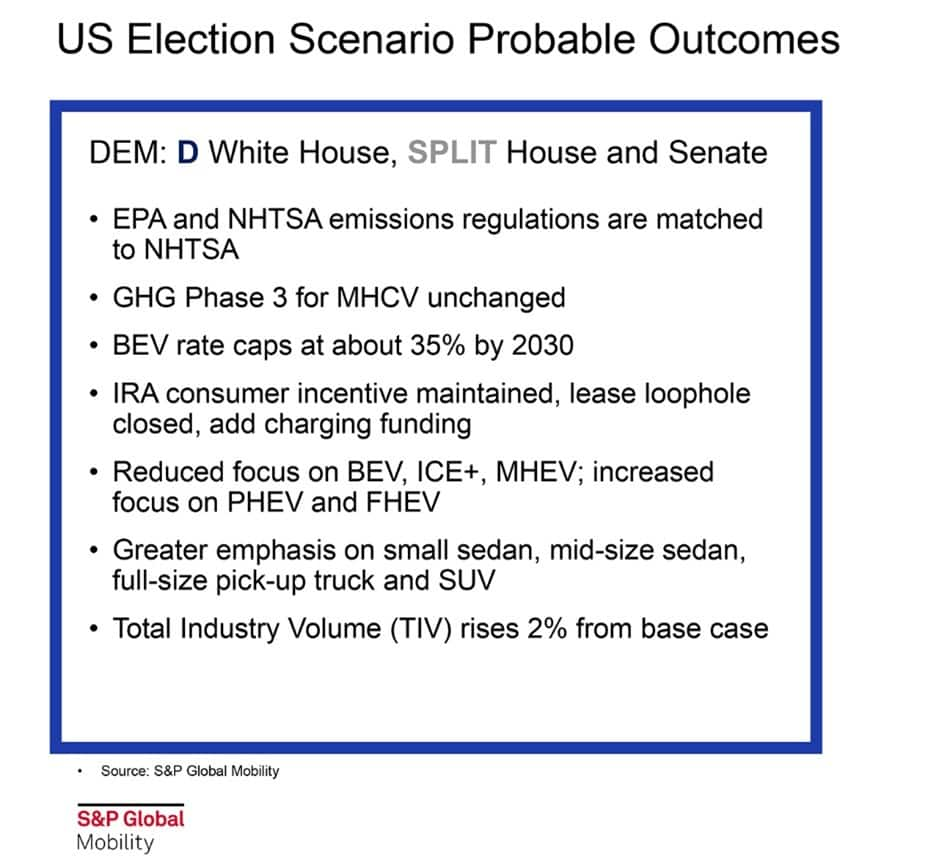

If the Democratic Party takes the White House

we think it is most likely that the Democrats will also see a split

House and Congress. This scenario could lead to EPA and NHTSA

emissions regulations matched to NHTSA guidelines and for IRA

consumer incentives to be protected. Though the lease loophole is

still likely to be closed, there is potential for additional

incentives for home chargers.

Under this scenario, we expect an increased focus on PHEV and

FHEV, with a reduced focus on BEV, ICE-plus and MHEV. The changes

could also create greater emphasis on sedans (small and mid-size)

as with the Republican scenario, though we expect full-size pickup

and SUV segments flattening. Total industry light vehicle volume

would increase 2% from our base case under this scenario.

Of note, seeing increased emphasis on small and mid-size sedans

in both scenarios also reflects that those segments have

traditionally been more affordable as well as more efficient than

trucks or utility vehicles. Regardless of political party, the US

market is in need of more vehicles at affordable price points, and

the industry, however slowly, will respond.

Conclusion

For the auto industry, uncertainty related to regulations has

been one of the most difficult elements to navigate, and

uncertainty is rampant today. The November 2024 election follows

other recent elections for having potential for massive impact on

the auto industry. The impact and related uncertainties touch

nearly every facet of the industry. Once the makeup of the next US

presidential administration and Congress are settled, the industry

should have a better grasp of what the next four years will look

like, relative to some US policies. Whatever changes or stays the

same in policy and regulation, a consistent framework is what the

industry needs to better navigate and understand how to compete

profitably in the US market.

Download the full special report

Watch the webinar

Listen to the podcast

Ask about our scenarios workshops